A record-breaking €1.4 billion passed through Ireland’s grocery tills in December 2023, according to the latest figures from Kantar. The average household spent an all-time high of €767 on groceries across the month, an increase of nearly €42 on 2022, and an even larger increase of €170 compared to spend in 2019. Take-home grocery value sales grew by 7.8%, while the number of packs bought declined by 5.3%. Irish shoppers made nearly 42 million trips over the four weeks to 24 December – 3.4 million more than last year and the largest number ever recorded at Christmas.

Emer Healy, Business Development Director at Kantar, explains: “As we expected, this Christmas was a mammoth month. Friday 22 December turned out to be the most popular shopping day over Christmas week. Irish shoppers spent €92 million in stores, with just over two million trips made on Friday 22 alone – meaning that over 36% of Irish households were in store that day. However, with Christmas day falling on a Monday shoppers had a full week to prepare, which led to more staggered shopping trips and making Saturday 23 the second busiest trading day, with €87m running through the tills.”

While value sales are up significantly, grocery price inflation remains the driving factor behind this as opposed to increased purchasing. Grocery inflation sits at 7.1% for the 12 weeks to 24 December 2023 – a considerable fall of more than half from the 15.5% rate in January 2023. Emer Healy says: “This is the eighth month in a row that there has been a drop in inflation, which will be welcome news for consumers. It is the lowest inflation level we have seen since August 2022, and we expect to see this gradual decline continue throughout 2024.”

Although grocery inflation levels are falling, they are still exceptionally high and Irish consumers face serious pressures on their household budgets. Emer Healy comments: “Retailers worked hard during the festive season to attract shoppers by offering the best value, and promotions were central to their strategy. Nearly 29% of all spend in the 12 weeks to 24 December 2023 was made on items with some promotional offer, the highest level since January 2023 and €117 million more than the previous year. Dunnes, Tesco and Online all saw strong growth in sales on promotion – ahead of the total market of 12.7%.”

Alongside promotions, retailers also placed emphasis on own-label lines, which have been attracting Irish shoppers throughout 2023. Unsurprisingly, private label goods remained popular over December, growing ahead of the total market at 10.4% year-on-year, and holding a 44.6% value share up 1.2 percentage points versus last year. In total, shoppers spent an additional €151m year-on-year on private label lines. Premium private label ranges also continued to perform strongly, with Irish shoppers looking to indulge over the festive season. They spent an additional €177 million on these lines' year-on-year, a growth of 11.8%.

However, Irish consumers also reached for more branded goods to treat themselves over the Christmas period, spending an additional €105 million compared Christmas 2022, an increase of 6.1%. This resulted in brands attaining their highest value share since January 2023, at 50.7%. Irish shoppers spent an additional combined €34.9 million on branded take-home confectionary and take-home soft drinks versus the previous year.

Irish consumers’ desire for the traditional Christmas dinner remained strong in 2023, with volumes of potatoes, carrots, and broccoli up 3.1%, 1.9% and 7.5% respectively, and turkey up 19.8%. Emer Healy says: “We’re creatures of habit when it comes to our Christmas feast and our data shows that the classic Christmas plate remains much the same. However, Brussels sprouts and mince pies bucked the trend; they were less popular with volumes down 2.4% and 9.3% respectively. Irish shoppers did not lose their sweet tooth altogether, with sales of seasonal biscuits, chilled desserts, and chocolate confectionary up 5.9%,12.6% and 3.2% respectively – showing that dessert was still on the menu. With more hosting taking place over the Christmas period, Irish shoppers spent an additional €10.4m on household and cleaning products and €2.2 million more on toiletries.”

Online sales remained strong over the 12 weeks ending 24 December 2023, up 22.6% year-on-year with shoppers spending an additional €36.6 million and making more frequent trips (+9.8%). The online channel also grew its shopper base by 1 percentage points, which helped to drive overall growth.

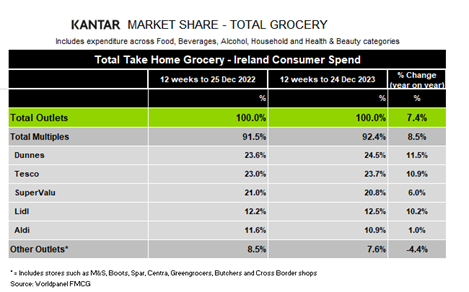

Dunnes, SuperValu and Tesco accounted for a combined market share of 69% during the 12 weeks to 24 December. Emer Healy comments: “Traditional retailers always tend to perform well in the run up to Christmas and 2023 was no exception. Sales were strong across their premium own-label lines, with spend on all ranges growing ahead of the total market.”

Dunnes, Tesco and Lidl all grew ahead of the total market in terms of value in December 2023.

Dunnes hit a new record share of 24.5%, with growth of 11.5% year-on-year. This stemmed from one percentage points increase in new shoppers, the highest penetration boost among all the retailers. Alongside more frequent trips and greater volume per trip this contributed an additional €41.2m to its overall performance.

Tesco holds 23.7% of the total market, which is a new record for the retailer and represents value growth of 10.9% year-on-year. Once again, Tesco has also seen the strongest frequency growth among all retailers, with a 12.4% year-on-year increase in trips. Combined with recruiting new shoppers in store, this contributed an additional €97.1m to its overall performance.

SuperValu holds 20.8% of the market, with growth in spend up 6%. SuperValu’s shoppers made the most trips overall when compared with all retailers – an average of 22.1 – which contributed to an additional €39.6m to their overall performance.

Lidl holds a 12.5% share of spend, with value growth of 10.2% year-on-year. New shoppers in store, together with more frequent trips, contributed to an additional €35.9m million. Aldi’s share of the total market is 10.9%, and it grew its value by 1% year-on-year. More frequent trips have contributed an additional €12.7 million to the retailer’s overall performance.